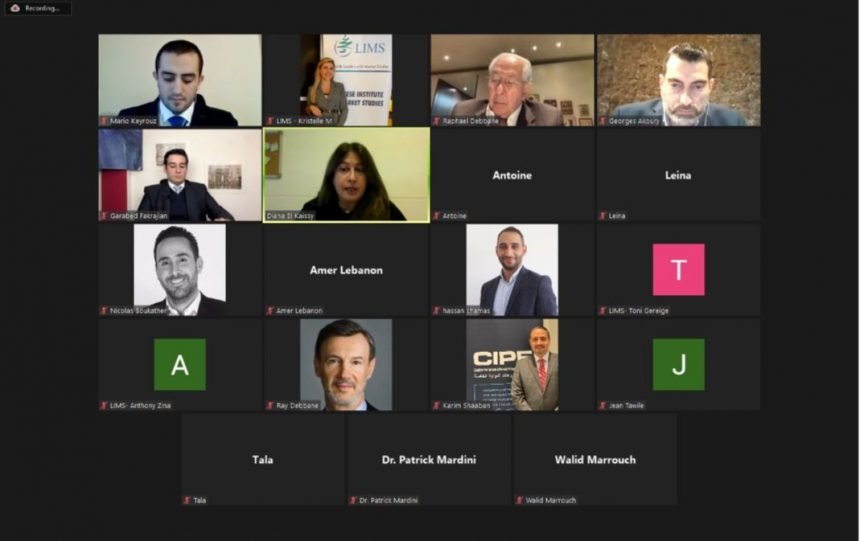

LIMS organized three virtual roundtables on November 10, 24, and December 6, 2021, with 52 businesspeople, industrialists, traders, bankers, experts, and civil society group leaders. The goal of the roundtables was to assess the impact of the monetary crisis on local businesses and have a better understanding of how they are coping with the currency volatility. The roundtables were very informative, and LIMS learned a lot from market participants.

A debate emerged during the roundtables between the need to float the exchange rate and the need to establish a currency board. Floating advocates highlighted the importance of exchange rate flexibility, to prevent a repeat of the current crisis. They believe a floating regime allows adjusting the exchange rate from time to time and prevents the piling up of foreign exchange reserve losses. Currency board advocates on the other hand, stressed on the instability of Lebanon and the weakness of local institutions. Under a floating regime, policymakers will persistently pressure the central bank to finance a never-ending budget deficit, creating permanent hyperinflation and repetitive devaluations.