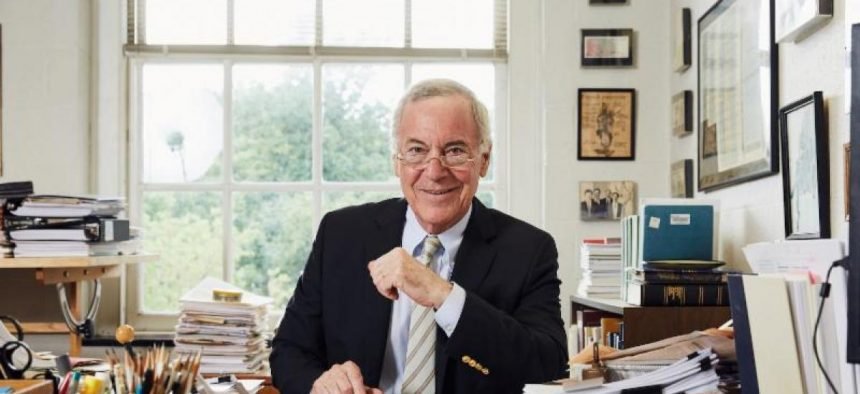

LIMS organized an online workshop gathering 13 members of parliament (MPs) and decision makers with Professor Steve Hanke, who is the world’s foremost authority on hyperinflation and a leading expert on currency boards. Professor Hanke has been measuring the annual inflation rate of Lebanon on a daily basis. He explained that after exceeding 50% per month, for 30 consecutive days in September 2020, Lebanon officially became the first MENA country and the 62nd country worldwide to suffer from hyperinflation. By his measure, inflation in Lebanon sits at 274% per year, much higher than the official inflation rate measured at only 136.8%.

Professor Hanke suggested establishing a currency board in Lebanon to resolve the currency crisis by covering 100% of the central bank’s Lebanese pounds (LBP) liabilities with a foreign reserve currency. This reform would separate the currency from politics, stabilize the LBP exchange rate, and stop hyperinflation in as little as 30 days. Launching a currency board would unfreeze LBP deposits, put a hard budget constraint on the government, and unify the official exchange rate with the black-market rate in a credible way. Professor Hanke compared the country’s current situation to the crisis of Bulgaria in the early 1990s, which defaulted on its debts several times between 1991 and 1997. After setting up a currency board, inflation in Bulgaria decreased to 1.6% and interest rates to 2.43%. The budget deficit turned into a surplus, and foreign exchange reserves rose from $864 million to $3.1 billion in just one year.

Extensive Media Interest in the Currency Board Reform

Attracting attention, the workshop was covered by 14 media outlets and followed by a series of TV, radio, and newspaper interviews where Professor Hanke and Dr. Mardini explained the critical components of a currency board. While local exit strategies from the crisis have focused on the liquidation of the economy and the distribution of the losses, the currency board solution would stabilize the Lebanese pound and help relaunch the economy by attracting capital inflows. Inflows would also improve state returns and reduce the banking crises. Establishing a currency board requires the parliament to amend the code of Money and Credit, to put an end to the discretionary monetary policy of the central bank. On another hand, LIMS also insisted on the danger of squandering both foreign currency and gold reserves. Wasting reserves will lead, in the medium run, to stronger devaluation of the currency. Fortunately, Law 42/1986 prohibits the sale of the gold reserves.